Every American resident who has a job or any other income is required to file a tax return each year in spring. You can file a tax return from January 1, but no one starts so early, because you often need to submit statements from various banks, insurance companies, and so on. They are usually sent throughout January. Usually, people start filling in the tax return after February 1. The deadline is usually April 15 of each year, but if it is a weekend, it is moved to the nearest weekday.

Who must file a U.S. tax return?

You have to file a tax return if you are:

- U.S. tax resident;

- Received a certain minimum amount of income for the past year.

Who is considered a U.S. tax resident?

U.S. tax residents are primarily U.S. citizens, permanent residents, worker visa holders (L1, H1-B, F1, etc.). In many cases, even a person who does not have the right to work may also receive some income (alimony, dividends, rent, royalties) and this person is also considered a tax resident.

What kind of income do you have to indicate in the tax return?

Almost all income can be taxed. Here is a small list:

- salary, bonuses, tips;

- dividends, interest on deposits;

- income from the sale of a property, securities;

- alimony;

- pension payments;

- all kinds of benefits (disability, unemployment, etc.);

- income from renting out real estate;

- royalties;

- prizes, winnings, court compensation;

- certain types of grants, including student grants;

- etc.

But not all tax residents need to report on their income. If you did not receive any income last year, or your income was very small – you do not need to declare anything. It also depends on whether you work, what age you are, your marital status.

In other cases: if you work for yourself, or have received income from dividends, tips, royalties, etc., and it exceeds a certain amount – then you are also required to file a tax return. There are so many rules that it is better to try to fill in a tax return than not to file one at all. In most cases, when answering the questions of the tax return, it will be clear whether you have to send it or not.

How to file a tax return?

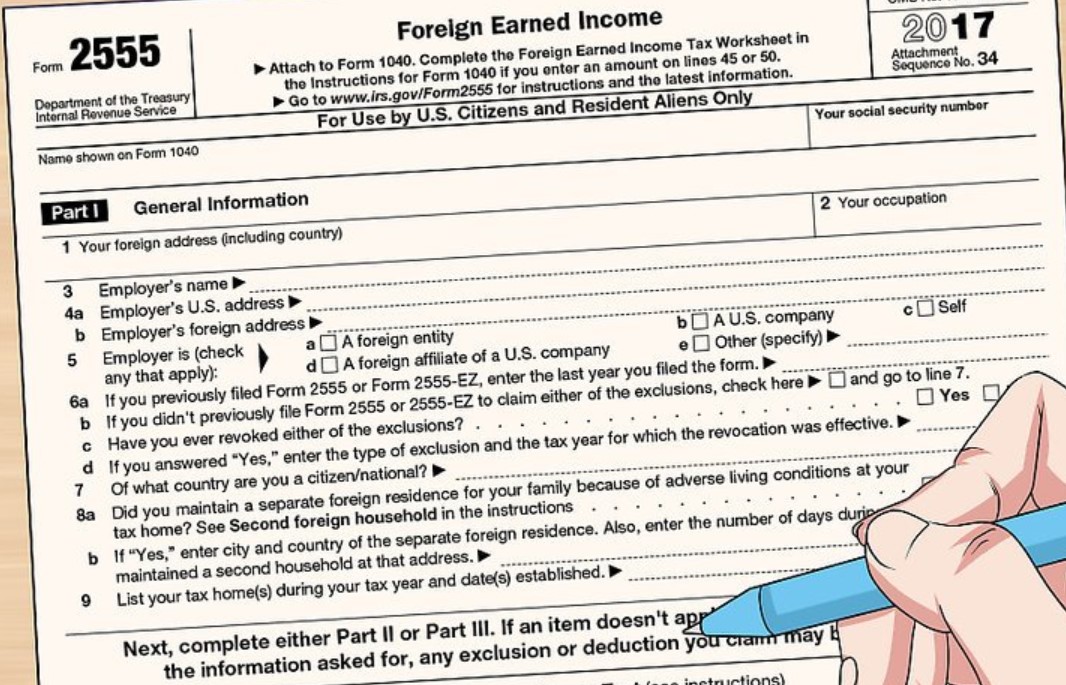

The tax return is sent to the IRS (Internal Revenue Service) in two main ways:

- Paper – for those who fill out the tax return by hand

- In electronic form, of course, it’s much more convenient. The IRS provides several ways to do this: by filling out tax forms directly on the IRS website and by using commercial services.

Of course, it is much more convenient to fill in the declaration electronically. We can safely say that most Americans do it in this way. If you are eager to find the best way to prepare documents for filing a tax return for a company, you can use the tax preparation tucson service https://southwesttaxassociates.com/. A professional company will help you to prepare all the documents correctly and under the law.